The Rs 600 crore ING Vysya Bank Ltd. is a premier private sector bank with retail, private and wholesale banking platforms that serve over two million customers, formed from the 2002 acquisition of an equity stake in the Indian Vysya Bank by the Dutch ING Group. The bank has over 80 years of history in India and leveraging ING’s global financial expertise, the bank offers a broad range of innovative and established products and services across its 530 branches. With about 10,000 employees, the bank has the greatest challenge of increasing competition and the need to build an effective eco-system for its customers to enhance interactions with multiple access channels.

Business Need that fuelled Mobility

The banking sector saw most forward-thinking organisations had started to adopt alternative channels like mobile and the Internet for banking services.

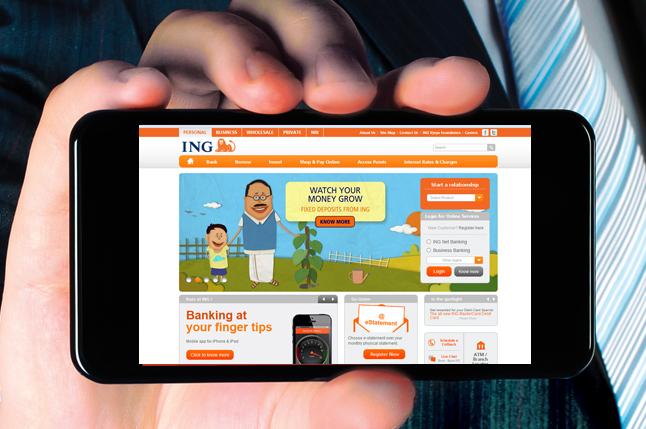

To be at a par with its peer groups, ING Vysya wanted to build an effective ecosystem for its customers to interact across multiple access channels, as well as extend its services across India. This paved the way to thinking about enterprise mobility. It was thus important for Aniruddha Paul, CIO, ING Vysya, and his team to adopt to this trend. “Enterprise mobility is about making available banking solutions for our customers at their fingertips irrespective of the device that they use. So, mobility by definition is agnostic. We don’t talk about whether our customers have got an iPhone handset or Android handset. We basically accept the fact that there will be a plethora of handsets and devices and that we needed to have a technology that is agnostic to that and focus more on the functionalities or business benefits that can be provided to customers at their fingertips,” says Aniruddha Paul.

With over 530 branches across India servicing more than two million customers, ING Vysya Bank required an application development platform that could quickly and securely build new mobile banking solutions. Further, mobile banking would allow the bank to further differentiate itself with better, more personalised services. ING Vysya Bank needed a solution to quickly deliver compliant and secure mobile banking apps, as well as effectively manage the whole app development life cycle.

The Solution

After evaluating available solutions in the market, and taking into account that the BYOD trend was still nascent, ING zeroed in on IBM Worklight, an integral part of the IBM Mobile First solutions portfolio, to help create crossplatform apps, as well as manage the whole app development life cycle. Using this technology, the bank has reduced the time to market and cost for product development. IBM Worklight also provides secure connectivity with the client’s back-end systems, allowing it to efficiently manage version upgrades, user data and audit data. With data capture capabilities, the bank is able to analyse patterns and trends of customer usage. “As the mobile revolution continues to change the way we interact with customers, transforming our services to meet these demands and deliver a consistent customer experience, regardless of the device or operating system, has become critical to our growth,” said Aniruddha Paul. “With an IBM mobile solution, we are now able to quickly and easily roll out new mobile services to support our business growth strategies.” The bank is the first IBM Worklight client in India to go live with a publicly downloadable app. Currently available on the Apple iOS mobile platform, ING Vysya Mobile apps will soon be extended to other platforms such as Android, BlackBerry and Windows Phone.

Evaluation process

The investment on Worklight was made about a year back and has been used in a variety of platforms. Worklight has been used to integrate within the internal systems. The internal integration capability also has a financial inclusion. For example, for people subscribing to Aadhaar and payment processing, there is a particular eco system that needs to be managed. The difference between one financial inclusion partner and another would be the extent of their real time support. Some companies do not give real time support, they essentially do it on a day basis; whereas some companies go in for a sophisticated online model where the authentication is done with their systems and then with bank’s systems in a real time environment. What is required is real time integration between existing framework and the new solutions. The IBM components at the back-end come into play for the integration.

Evaluation Criteria

Evaluation parameters revolved around aspects like the best offering on open ID for developing mobile applications, best support, capabilities in the integration layer at the server level and support for real time analytics. While evaluating and selecting the partner, Paul looked at the vision of the vendor in mobility, whether it was just a point in time or whether it was a part of a longer roadmap. The other factors were support for multiple mobile operating environments and devices with the simplicity of a single, shared code base, ease to connect and synchronise with enterprise data and applications, ensuring mobile security at the device, application and network layer and governing mobile app portfolio from one central interface.

Implementation Process

“As phase one of the project, the ING Vysya mobile app was made available on the iOS platform. Our banking apps will be extended to other platforms such as Android, BlackBerry, Windows and Java,” says Paul. He adds, “Using the app, our customers can pay utility bills, transfer funds to other accounts, view mini-statements, request cheque books, stop payment of cheques, and locate the nearest ATM and branches with their mobile device, among other features.

The implementation process for customer facing applications was very different from the normal procedures. The initial focus was on customer research because the IT team realised the mobility use case would be very different from other use cases. It was a user experience led process. Workshops and brainstorming sessions were conducted with customer representatives and internal teams to identify the aspects that people considered on a mobile application.

In

In

Add new comment